Clowns to the left, jokers to the right.

I don’t know when I decided to choose the energy industry as a career. I suppose i had a bit of history, my old man was in the oil business and my grandfather worked oilfield services. The lineage stops at my great-grandfather, who came over to America on a boat from Europe and started drilling.

I wanted to take a closer look at the age distribution in oil and gas employment. When I joined the industry there was great talk of “The Gray Wave,” the experienced engineers retiring and the “Crew Change” coming off new hires. This is visible in the data, with total employees rising thanks to hiring in the 2000s and early 2010s.

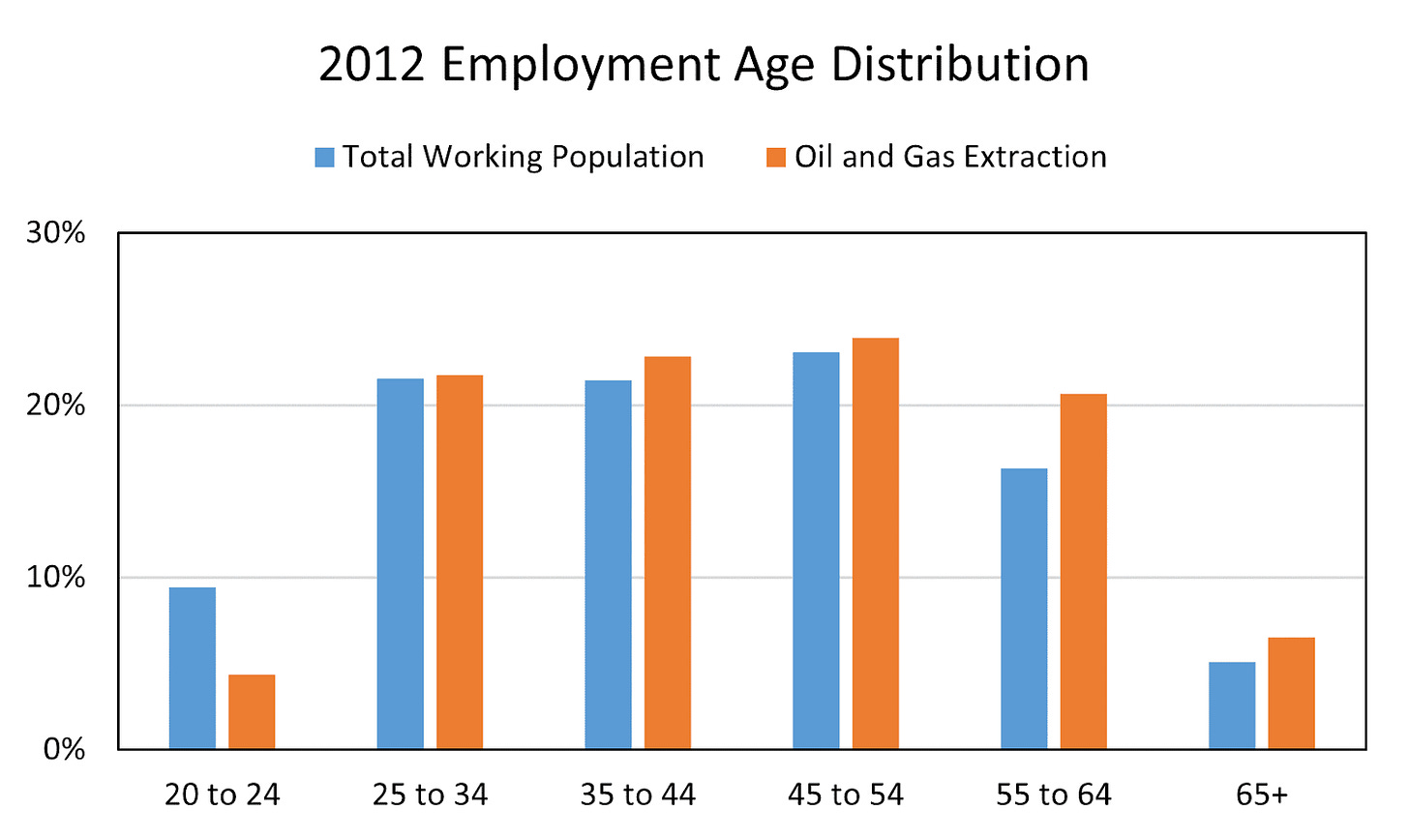

About a decade ago, close to the local maximum of employees in the industry, the age distribution was healthy and followed the national average. The $100 oil years put dollar signs in many petroleum engineering graduates in my beloved Petro State, and Texas was even a bit cushioned in the larger recession by some of the oil employment.

It is a boom and bust industry, and you can see the cliff of employee count fall over with the 2014 crude price declines. Who quit the industry is an interesting question. In every downturn I’ve experienced the younger engineers sprint to other industries, mid-career folks normally hang around unless laid off, and the older crew takes the packages if provided. This brings about the current employee age distribution.

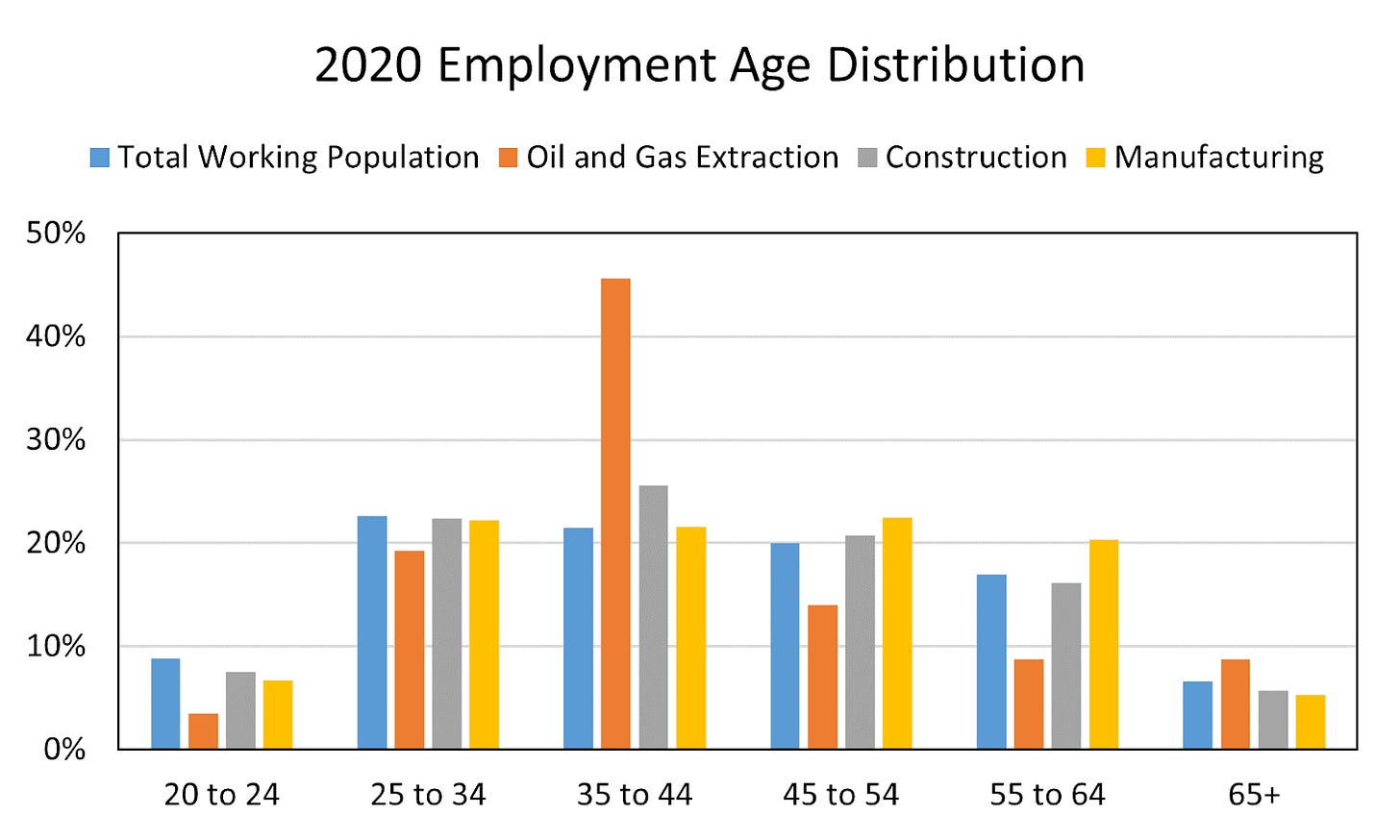

Close to half of all oil and gas extraction employees are between 35 and 44 years old. This is the strangest distribution, attributable to the multiple oil price downturns and transition positioning. The pandemic also brought cuts all across the industry, and it was typical that old-timers saw the low interest rates very favorable for pension calculations, so off they went and sometimes with a severance package. Hiring was frozen and offers even rescinded, eliminating the new employee pool for a few years. All that was left were the mid-career people, those normally with 10-plus years experience and kids that meant moving in a pandemic wasn’t easy.

Russel Gold wrote a great Texas Monthly article on the new faces of the oil industry, it’s not the normal cast of characters portrayed in media these days.1 I’ll let the reader guess where I lie in the age distribution.

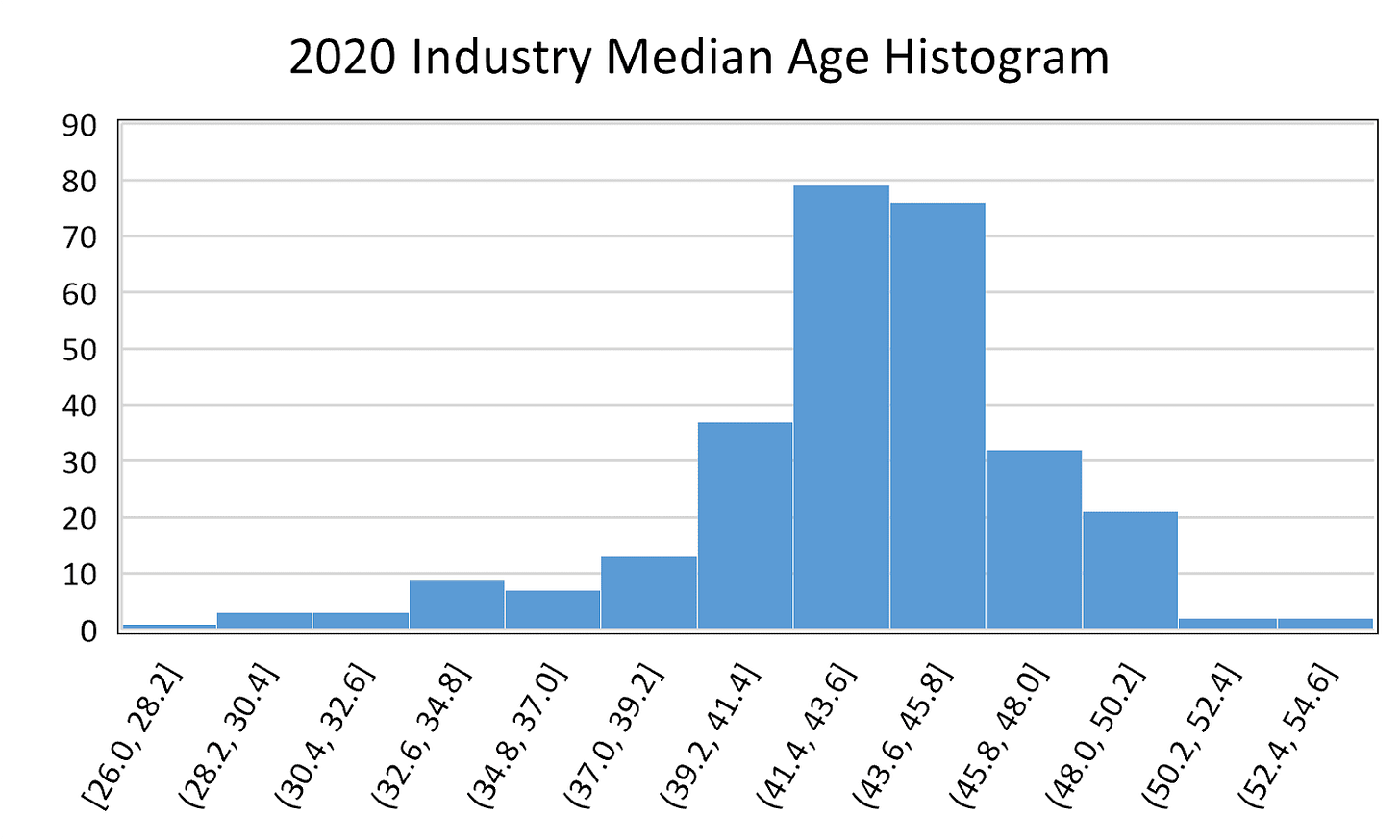

Indeed the oil and gas distribution is very odd compared to similar broad industry groupings such as construction and manufacturing, which follow closer to the total working population. It is also odd that the concentration is of relatively young employees and not older staff. The youngest BLS industry is “Shoe Stores” and the oldest “Sewing Goods Stores,” and the median age of these industries skews extremely young and old. Median oil and gas employment age is actually quite near the total working population median.

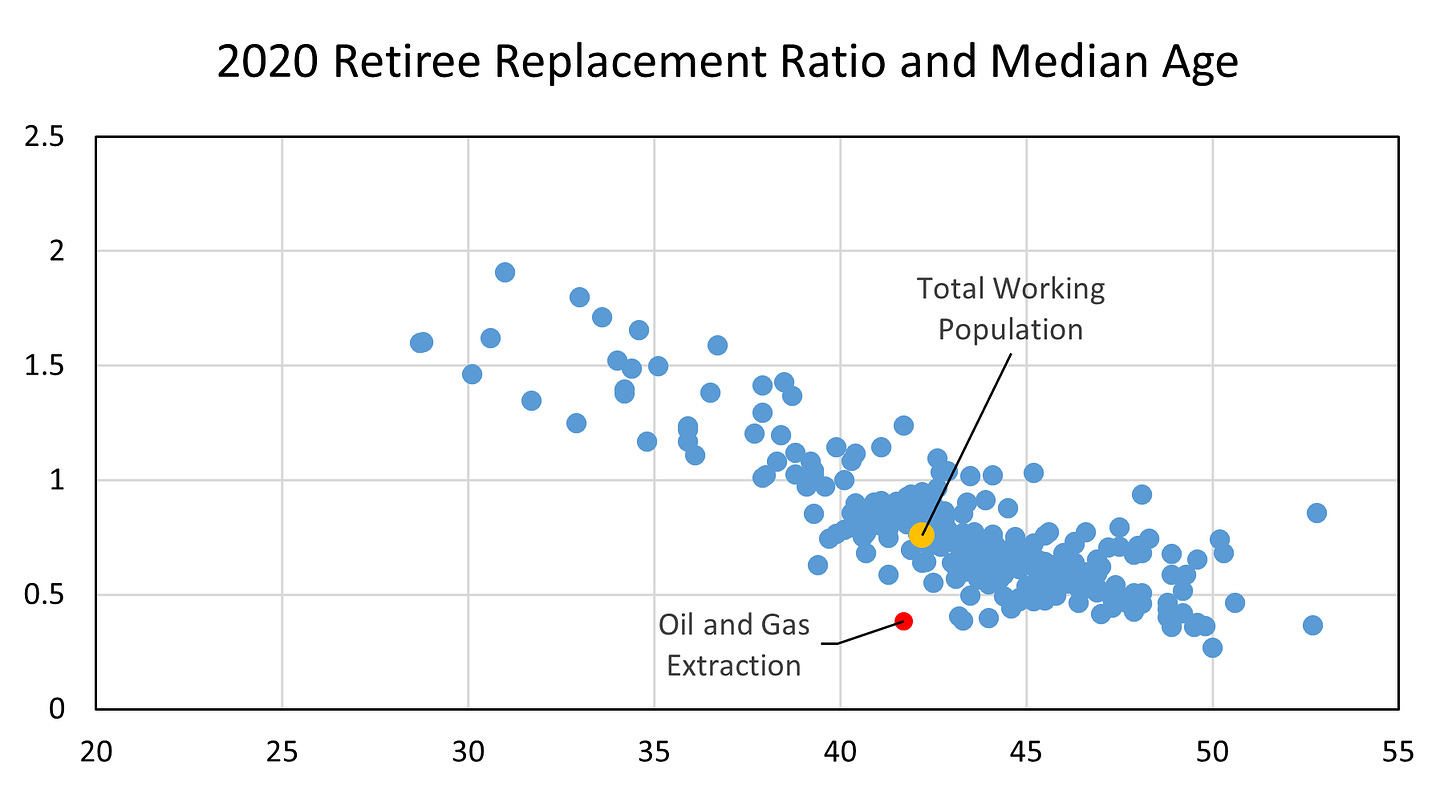

To show the odd distribution of age I defined the Retiree Replacement Ratio (RRR) for each industry. The RRR is the total number of employees between 20 and 34 divided by the total number of employees between 35 and 54. How many early-career employees are in the industry to replace the mid-career. I ignore 55+ for a bit of convenience, they are on the downhill of the workforce and exiting industry soon.

A younger industry has a higher retiree replacement ratio, and graphing all industry breakdowns from the BLS yields an interesting graph. A collection of industries skews younger with higher RRR. The youthful Shoe Store industry is the only one not shown on the graph with a RRR of 4.

My RRR is a play on the E&P industry metric of Reserve Replacement Ratio, defining the amount of oil and gas reserves a driller replenishes its inventory through exploration. RRR is normally applicable to barrels defining the lifespan of a company, I’ve adopted it to show the replacement of employees. Plotting the median industry age with RRR the oil and gas industry is an outlier, with a very low retiree replacement ratio.

This low RRR is from the lack of new hires. The industry did itself no favors when it froze hiring in the pandemic, and is looking to make up for lost time by hiring younger talent. But we’ve seen the effect of boom and bust reported every cycle, even last week from the WSJ.2 College graduates aren’t as interested in oil and gas, anecdotally I estimate due to the longevity concerns of the industry. I make no comment on NetZero goals, but a NetZero 2050 target isn’t a full career for a 2023 graduate.

Oil and gas is still needed for years to come, but the transition has begun in energy development. The transition is also occurring for engineers and practitioners of the incumbent industries. Will I be working on drilling a well in the twilight of my career or on a solar farm powering the extraction? As oil and gas companies react to the lower carbon world I’ll be interested in how the employee population adapts.

A great read on the new cycle of young CEOs https://www.texasmonthly.com/news-politics/permian-resources-oil-midland-young-ceos/

The charts presented are essentially why I didn’t study petroleum engineering. Too risky for me. https://www.wsj.com/articles/big-oils-talent-crisis-high-salaries-are-no-longer-enough-194545be